College Planning

I need to save for my kid’s college fund…I guess I’ll never be able to retire.

With a Bank On Yourself policy you can do both. You can fund your child’s tuition and then recapture the money to finance your retirement. Some education funds dictate how and when that money can be used. With a custom policy from Deborah Gamber, you choose how and when to use the money. Even if you decide not to use the policy to fund college tuition, your money will continue to grow, tax-free (as long as structured properly). Or you can use it to fund other expenses like your son or daughter’s first car or a down payment on a starter home.

Watch this youtube video for ideas of how to fund college AND save for retirement…..

If I use the Bank On Yourself method for my child’s college fund, will she still qualify for financial aid?

Another major advantage with a Bank On Yourself policy is that it won’t impact your child’s eligibility for financial aid or student loans. Permanent life insurance is one source of education funding that will not be taken into consideration for the purposes of determining your child’s eligibility for federal financial aid.

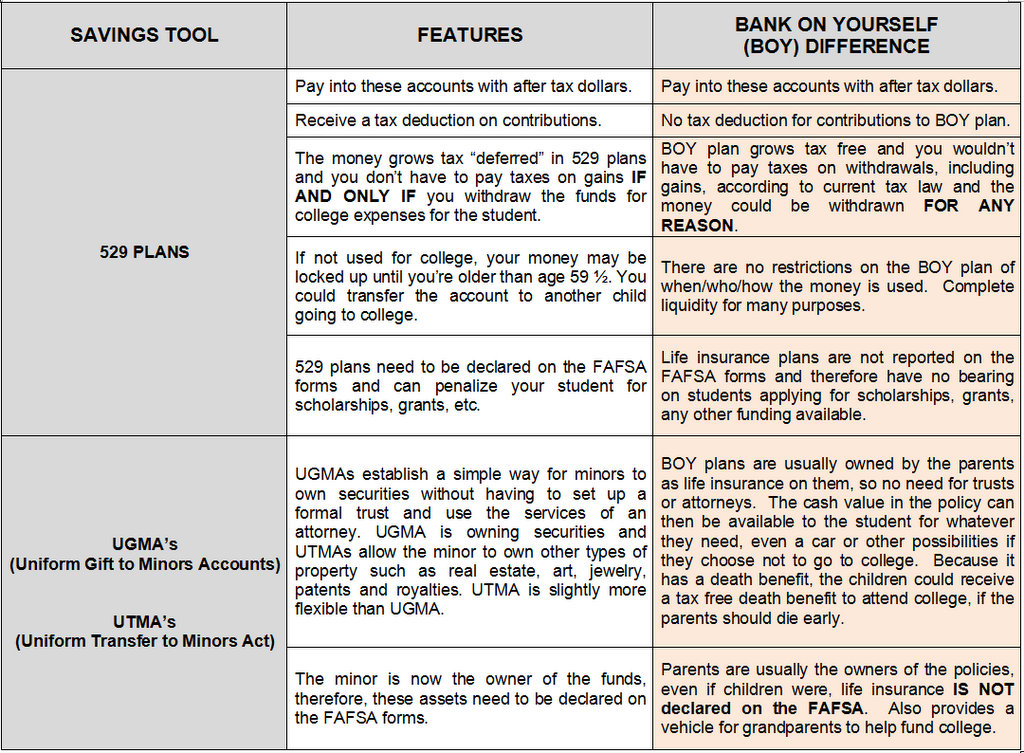

Too many Americans pay for college with money that “could” have gone to finance their retirement and to enjoy more of life’s luxuries. Here are a few traditional college savings plans being used today and how they compare with the ‘Bank on Yourself’ (BOY) method.

Bank on Yourself: A Better Way to Save and Pay for College

Watch this video to learn how a specially designed dividend-paying whole life insurance policy from a Bank on Yourself Authorized Advisor may be the safest and best way to save for college tuition to meet the rising costs of education.

Therefore, by using the Bank on Yourself concept to finance a college education, you have many advantages over the traditional methods of saving for college.

-

Don’t have the risk of loss due to market fluctuations

-

You can recapture the money you pay for college and use it to finance numerous things during your retirement years: such as vacations, purchasing vehicles, houses, business investments and tax free retirement income (when policies are structured correctly with current tax laws)

-

No restrictions on what the money is used for, whether the student goes to college or not

-

No penalties in applying for financial aid or scholarships

-

Money is guaranteed to grow every single year as it has for other owners of dividend paying whole life insurance for over 160 years

-

Still a possibility for college funding, even if you start a plan when a child is in high school